Fx bid ask spread historical data images are available. Fx bid ask spread historical data are a topic that is being searched for and liked by netizens now. You can Download the Fx bid ask spread historical data files here. Get all royalty-free images.

If you’re searching for fx bid ask spread historical data images information related to the fx bid ask spread historical data keyword, you have come to the right site. Our site frequently provides you with suggestions for seeking the maximum quality video and image content, please kindly surf and find more informative video articles and graphics that match your interests.

In each file youll get from us here are the fields order of all bar based data. Bid-Ask Spreads in the Retail Forex Market. This analysis has looked at only a fews days data and as noted the period following the change was just before a major US holiday. This is annualised data put out by the US Department of Agriculture Economic Research Service and isnt too bad. All other trademarks appearing on this Website are the property of their respective owners.

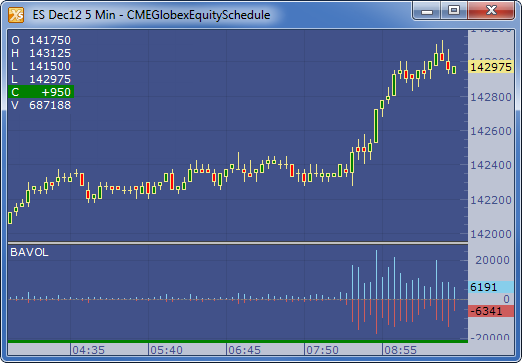

Fx Bid Ask Spread Historical Data. Figures in small type are the average of the min and max spread recorded for each minute to smoothe out very short-term unrepresentative peaks in the spread during news. Login below to access the tool. Analyze current and historical bid-ask spreads book depth and cost to trade statistics for CME Group products across three distinct global time zones. OANDA fxTrade and OANDAs fx family of trademarks are owned by OANDA Corporation.

Trading Glossary Kraken From support.kraken.com

Trading Glossary Kraken From support.kraken.com

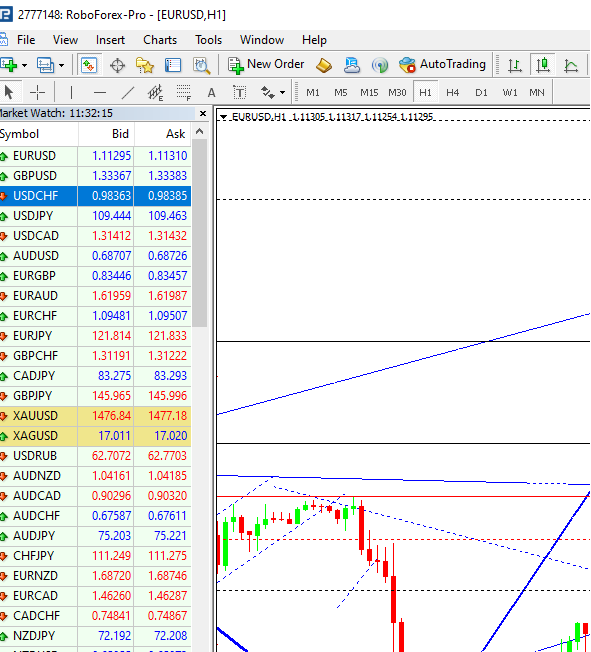

OANDA fxTrade and OANDAs fx family of trademarks are owned by OANDA Corporation. Analyze current and historical bid-ask spreads book depth and cost to trade statistics for CME Group products across three distinct global time zones. Spread in pips as reported by MT4 ask and bid prices on every tick between 1 February 2021 and 5 February 2021. This analysis has looked at only a fews days data and as noted the period following the change was just before a major US holiday. This represents a spread of 1 pip. Low liquidity stocks.

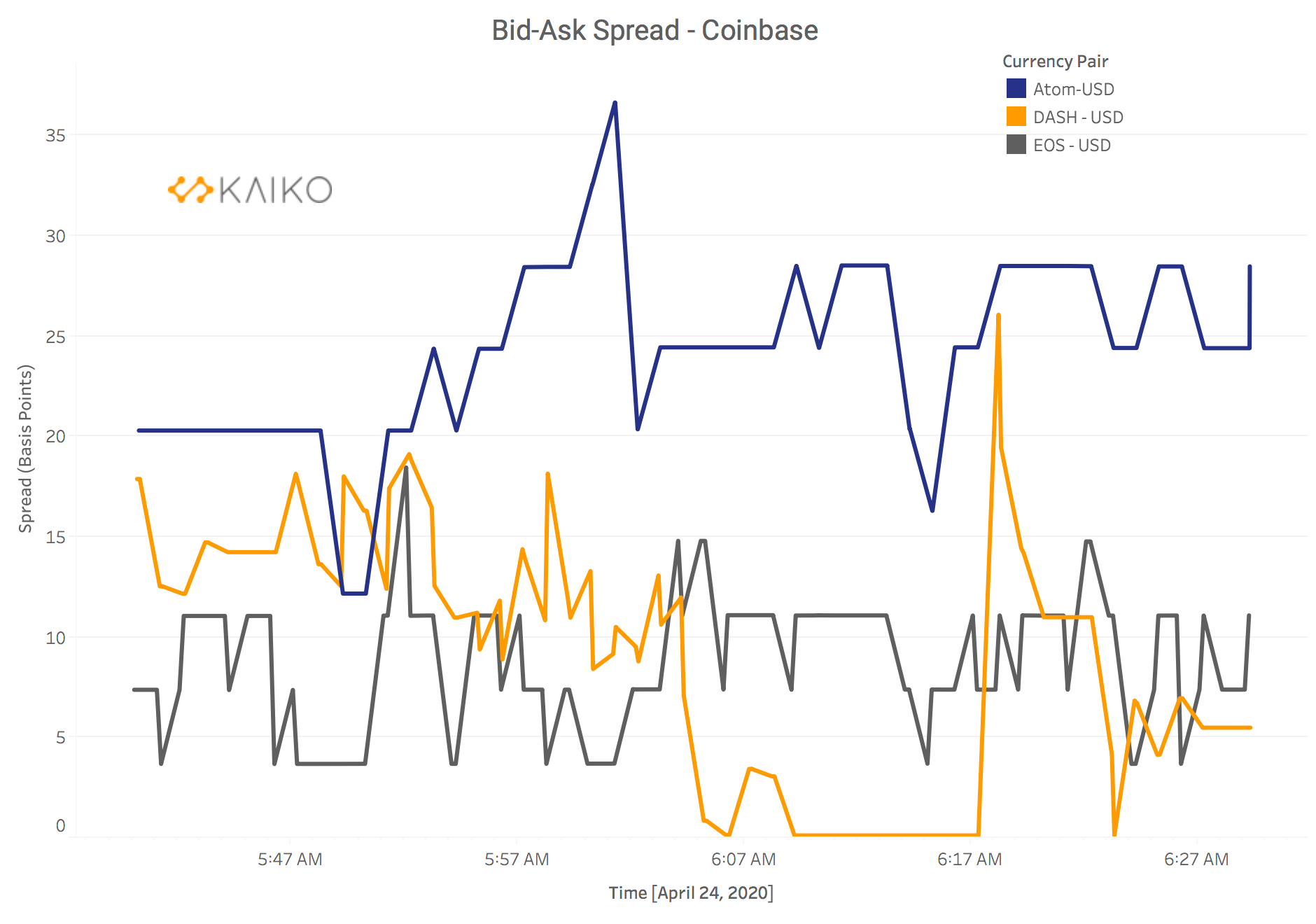

If assets or securities have large bidask spreads ie the difference between the bid and ask is 01 or more the price of the security they are also likely to have sizable gaps in the bid and ask spreads in the market depth data.

Here are three sites I can recommend. I hope this lesson has helped you to better understand the Forex bid ask spread as well as when to take extra care and watch for larger-than-usual spreads. This is a commercial service which can supply a currency instream but also provides historical data and a fair amount of info available free from the site. SPREAD ASK BID For example the EURUSD BidAsk currency rates are 1125011251. OANDA fxTrade and OANDAs fx family of trademarks are owned by OANDA Corporation. Rates are updated tick-by-tick in periods of less than a second.

Source: tradingtechnologies.com

Source: tradingtechnologies.com

Intraday bid ask in other words the order book is very huge a data set and is very costly and very rare to get in a downloaded format for free. The quantity of the asset that market participants are looking to buy at the various bid prices. You will buy the pair at the higher Ask price of 11251 and sell it at the lower Bid price of 11250. View and compare BIDASKSPREAD on Yahoo Finance. This is a commercial service which can supply a currency instream but also provides historical data and a fair amount of info available free from the site.

Source: investexcel.net

Source: investexcel.net

This represents a spread of 1 pip. This is annualised data put out by the US Department of Agriculture Economic Research Service and isnt too bad. This represents a spread of 1 pip. With both Bid and Ask youll have the spread value for each specific tick. Analyze current and historical bid-ask spreads book depth and cost to trade statistics for CME Group products across three distinct global time zones.

Source: fortrader.org

Source: fortrader.org

Now that we have a better understanding of the two prices that make up the Forex bid ask spread lets take a look at how the spread. Try checking the exchange on which the trades are regulated. The bid price is the exchange rate at which the market maker will purchase the currency pair while the ask price is the exchange rate at which they will sell the currency pair. This is a commercial service which can supply a currency instream but also provides historical data and a fair amount of info available free from the site. I hope this lesson has helped you to better understand the Forex bid ask spread as well as when to take extra care and watch for larger-than-usual spreads.

Source: hodlbot.io

Source: hodlbot.io

Leveraged trading in foreign currency contracts or other off-exchange products on margin carries a high level of risk and may not be suitable for everyone. ERS International Macroeconomic Data Set. Intraday bid ask in other words the order book is very huge a data set and is very costly and very rare to get in a downloaded format for free. The bid price is what the dealer is willing to pay for a currency while the ask price is the rate at which a dealer will sell the same currency. For tick data files here are the fields order of the supplied data.

Source: hodlbot.io

Source: hodlbot.io

View and compare BIDASKSPREAD on Yahoo Finance. See real-time bid and ask rates being accessed by forex and CFD traders right now on OANDAs trading platform. This is a commercial service which can supply a currency instream but also provides historical data and a fair amount of info available free from the site. Analyze current and historical bid-ask spreads book depth and cost to trade statistics for CME Group products across three distinct global time zones. With both Bid and Ask youll have the spread value for each specific tick.

Source: sciencedirect.com

Source: sciencedirect.com

This tool is primarily used to calculate average cost-to-trade statistics for given lot sizes. Spread in pips as reported by MT4 ask and bid prices on every tick between 1 February 2021 and 5 February 2021. This tool is primarily used to calculate average cost-to-trade statistics for given lot sizes. This is my favourite site for. A current glimpse and the bid-ask does change all the time has the stocks bid at 18924 and the ask is at 18928 - for a bid-ask spread of four cents.

Source: blog.kaiko.com

Source: blog.kaiko.com

This is annualised data put out by the US Department of Agriculture Economic Research Service and isnt too bad. The quantity of the asset that market participants are looking to buy at the various bid prices. With both Bid and Ask youll have the spread value for each specific tick. Login below to access the tool. See real-time bid and ask rates being accessed by forex and CFD traders right now on OANDAs trading platform.

Source: pinterest.com

Source: pinterest.com

The bid price is what the dealer is willing to pay for a currency while the ask price is the rate at which a dealer will sell the same currency. What are the order of the fields in the exported data. The VWAP bid-ask spread has improved by an average of 02 pips for the whole trading day demonstrating that the MPI change in AUDUSD is improving the liquidity available in the futures market. With both Bid and Ask youll have the spread value for each specific tick. Now that we have a better understanding of the two prices that make up the Forex bid ask spread lets take a look at how the spread.

Source: support.kraken.com

Source: support.kraken.com

The dealing spread observed in quotations made by forex market makers is simply defined as the difference between a currency pairs bid and ask price. Try checking the exchange on which the trades are regulated. We are electronically connected to numerous global banks to access the most accurate foreign exchange and CFD rates for our clients. Analyze current and historical bid-ask spreads book depth and cost to trade statistics for CME Group products across three distinct global time zones. This tool is primarily used to calculate average cost-to-trade statistics for given lot sizes.

Source: in.pinterest.com

Source: in.pinterest.com

If assets or securities have large bidask spreads ie the difference between the bid and ask is 01 or more the price of the security they are also likely to have sizable gaps in the bid and ask spreads in the market depth data. This tool is primarily used to calculate average cost-to-trade statistics for given lot sizes. All other trademarks appearing on this website are the property of their respective owners. Spread in pips as reported by MT4 ask and bid prices on every tick between 1 February 2021 and 5 February 2021. Bid-Ask Spreads in the Retail Forex Market.

Source: cmegroup.com

Source: cmegroup.com

Spread in pips as reported by MT4 ask and bid prices on every tick between 1 February 2021 and 5 February 2021. Leveraged trading in foreign currency contracts or other off-exchange products on margin carries a high level of risk and may not be suitable for everyone. Always check the bid ask spread before placing a trade. Now that we have a better understanding of the two prices that make up the Forex bid ask spread lets take a look at how the spread. Spread in pips as reported by MT4 ask and bid prices on every tick between 1 February 2021 and 5 February 2021.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title fx bid ask spread historical data by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.